The following was provided by Isaac Tawil, of Tawil Tax & Accounting Solutions.

The following was provided by Isaac Tawil, of Tawil Tax & Accounting Solutions.

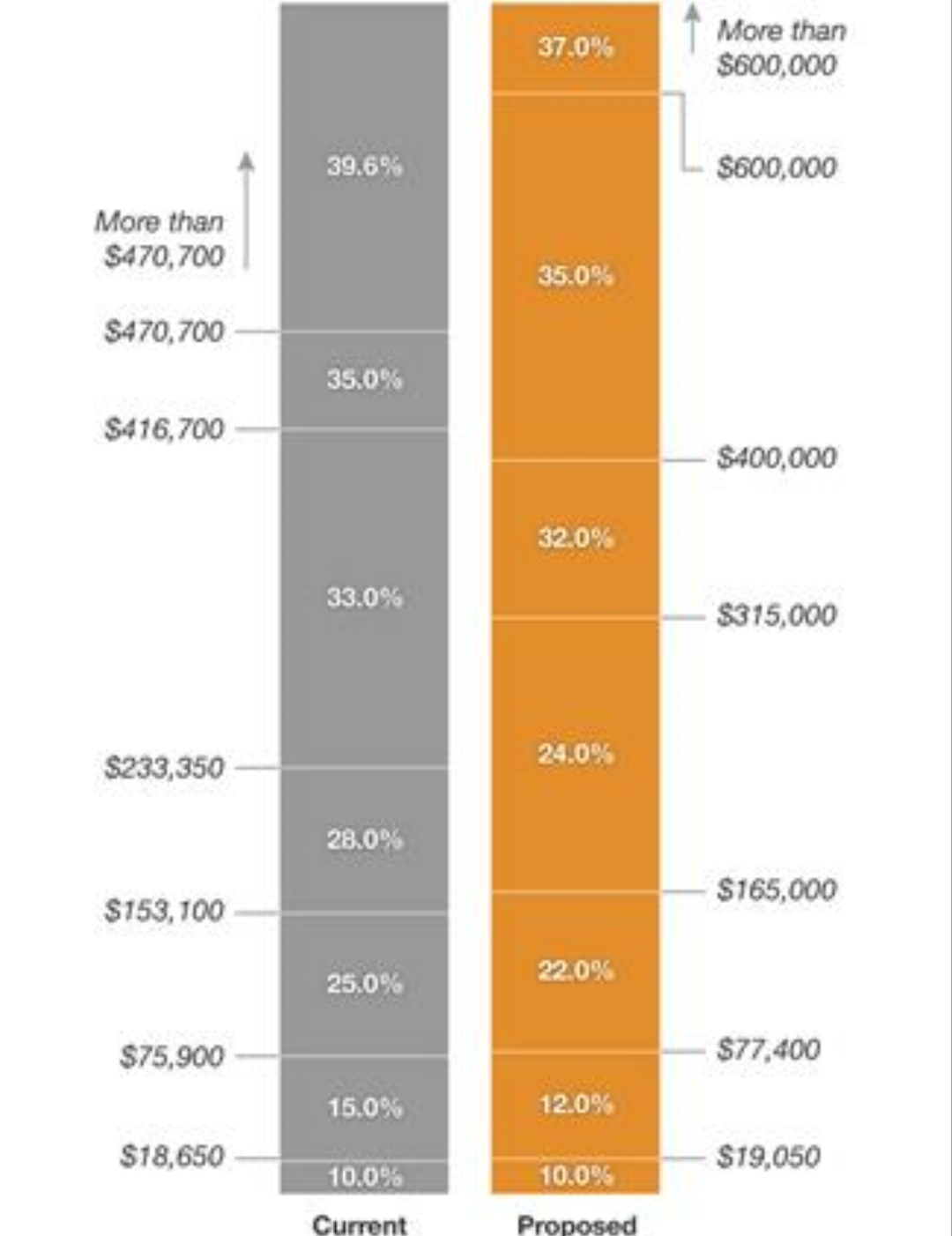

1. LOWER TAX RATES ACROSS THE BOARD – Below is a comparison of current tax rates compared to the new ones for married couples published by NPR.

2. BIGGER CHILD TAX CREDIT – Under current tax law the child tax credit is $1,000 per child. This will change to $2,000 per child, of which $1,400 will be refundable, meaning it will be granted even if no taxes are owed to offset it.

3. 20% DEDUCTION FOR PASS-THROUGH ENTITIES – This is great news for LLCs, partnerships, and S Corporations. It appears that there will be limitations to this deduction for those in service industries (details still unknown). Additionally, there is concern that many wage earners will attempt to reclassify their income as pass-through income in order to qualify for this deduction. This may be cause for more scrutiny of individuals with pass-through income. Regardless, this deduction is great news for many people.

4. INCREASE IN STANDARD DEDUCTION TO $24,000 – This increase is almost double the current standard deduction. It is speculated that many people will begin using the standard deduction instead of itemizing their deductions (medical, mortgage interest, property taxes, charity) as the standard deduction will be higher.

5. MEDICAL EXPENSES DEDUCTIBLE IN EXCESS OF 7.5% OF AGI – Under current law medical expenses were only deductible to the extent they exceeded 10% of AGI. This has been reduced to 7.5%, giving those with medical expenses a greater deduction.

6. CORPORATE TAX DEDUCTION REDUCED TO 21% – Simply great news. Companies will be enticed to open/relocate here creating more jobs which should positively impact the economy. Stock prices in American companies should rise as the companies will retain 14% more of their income than they had in the past.

7. REPEAL OF THE INDIVIDUAL MANDATE – Awesome! You will no longer be penalized for not purchasing health insurance.

8. ELIMINATES ESTATE TAX FOR ANY ESTATE UNDER $10.98M – Under current law the exemption amount is $5.49M.

BAD NEWS

1. ELIMINATION OF PERSONAL EXEMPTIONS – Currently every taxpayer gets a $4,050 deduction for each member of his or her family. This deduction is being eliminated entirely. While this is not good news, its negative effects will be far outweighed by the increase in the standard deduction and the increase in the child tax credit. The only taxpayers that stand to lose from this change are those with no dependents whose itemized deductions are greater than $24,000.

2. LIMITATION OF STATE AND LOCAL TAX DEDUCTION TO $10,000 – Currently taxpayers are entitled to a deduction for property taxes they pay as well as state and local income taxes or sales tax they pay. This deduction will now be capped at $10,000 total. This is terrible news for many NY and NJ taxpayers whose property taxes alone are generally in excess of $10,000 and whose state and local income taxes are among the highest in the country. We are hopeful that the positive effects of lower tax rates will outweigh the negative effects of this provision. The silver lining – states will think twice before increasing their tax rates!

3. MORTGAGE INTEREST ONLY DEDUCTIBLE FOR LOANS OF $750K AND UNDER – The current limit is $1M. This provision will not affect those who already have mortgages in excess of $750k.

4. HOME EQUITY LINES OF CREDIT NO LONGER DEDUCTIBLE – Currently these are deductible for loans up to $100k.

4. HOME EQUITY LINES OF CREDIT NO LONGER DEDUCTIBLE – Currently these are deductible for loans up to $100k.

INDIFFERENT NEWS

1. NO CHANGE TO QTR – A huge deal for rebbeim and teachers! Many schools currently give their staff a non-taxable fringe benefit known as a Qualified Tuition Reduction which enables them to pay the tuition of their employees’ dependents without the employee recognizing it as income and paying taxes on it. Aside for the tax benefits, this also enables teachers to qualify for certain welfare programs they otherwise wouldn’t be. There was chatter that the tax bill would eliminate QTR. That would have been a disaster to many teachers as well as any parent with a child in private school who would ultimately pay the inevitable salary increases.

2. $250 SUPPLIES DEDUCTION FOR TEACHERS TO STAY – Teachers are currently entitled to a deduction of up to $250 for supplies they pay for out of pocket. The early versions of the bill called for the removal of this credit. However, ultimately no change was made.

3. EXCLUSION OF SALE OF MAIN HOME FROM CAPITAL GAINS TAX – Currently anyone selling their main home at a gain of up to $250k for individuals or $500k for married couples could exclude that gain from income and avoid paying the capital gains tax on it. Current law defines a main home as one that the taxpayer resided in for 2 out of the last 5 years. There was a lot of talk of removing this exclusion entirely or at least limiting those who qualify by redefining a main home as one where the taxpayer resided for 5 out of 8 years. Thankfully, no change was made to this provision.

One final note – while expected to pass, the bill is not the law yet. Additionally, these changes will not affect your 2017 taxes .

Please do not hesitate to contact our office with any questions or to schedule a consult.

Isaac Tawil

Tawil Tax & Accounting Solutions

DOES IT PAY TO PRE PAY TAXES FOR YEAR 2018 NOW ?

PROPERTY TAX

I am a personal fan of Mr. Tawil. That being said, I think there are a couple inaccuracies:

1. The elimination in personal exemptions is HUGE! And it will NOT be “outweighed” for many people. The frum families who, by and large, have large families can be hit badly. Example- a family with 7 children will get an exemption of $36,450 (9 people) under the current law. For someone in the 25% tax bracket (2017 brackets) that would be equivalent to a $28,000 “deduction”. That would still be $8,450 short of the amount they would have received in personal exemptions. For those with kids 18 and over, they don’t get any tax credit for this kids.Yes- some can be made up with the increased standard deduction, but many people would be deducting close to $24k under the current system anyway, due to charity, SALT, etc.

2. The decrease in medical expenses to be deductible in excess of 7.5% is becoming law RETROACTIVELY, meaning that it is relevant to the tax returns that will be filed shortly in 2018, for the 2017 year.

As you noted, there are many positives, and many people may come out better in the big picture, but there will definitely be some who will be hurt by this.

Thank you for all you do!

If your tax bracket is 25% or less, the elimination of the $4,050 exemption per child is offset by the DOUBLING of the child tax credit from $1,000 to $2,000.

All is good.

Incorrect. See my post a few posts below where I corrected a sentence that got deleted accidentally.

Each $1,000 credit is equivalent to $4,000 of “deduction” for someone in the 25% bracket.

There fore, in my scenario, the additional $7,000 in child tax credits ($1,000 per child) will only give you what is equivalent to $28,000 of “personal exemption deduction” for someone in the 25% tax bracket.

That is still more than $8,000 short.

that 8K at 25% makes you only 2K short?

A few pieces of the puzzle that you are leaving out:

* Someone in the 25% bracket will now be in the 22% bracket

* Most people in your scenario were impacted by AMT, which is now a non factor

* I would imagine most in the 25% tax bracket were seeing their current Child Credit begin to phase out. Also no longer a factor.

this was the best written article on the subject! thanks so much!

I am a personal fan of Mr. Tawil. That being said, I think there are a couple inaccuracies:

1. The elimination in personal exemptions is HUGE! And it will NOT be “outweighed” for many people. The frum families who, by and large, have large families can be hit badly. Example- a family with 7 children will get an exemption of $36,450 (9 people) under the current law. For the child credit he will now get an extra $7,000 (assuming all his kids are under 18 years old). For someone in the 25% tax bracket (2017 brackets) that would be equivalent to a $28,000 “deduction”. That would still be $8,450 short of the amount they would have received in personal exemptions. For those with kids 18 and over, they don’t get any tax credit for this kids.Yes- some can be made up with the increased standard deduction, but many people would be deducting close to $24k under the current system anyway, due to charity, SALT, etc.

2. The decrease in medical expenses to be deductible in excess of 7.5% is becoming law RETROACTIVELY, meaning that it is relevant to the tax returns that will be filed shortly in 2018, for the 2017 year.

As you noted, there are many positives, and many people may come out better in the big picture, but there will definitely be some who will be hurt by this.

Thank you for all you do!

I believe that 2018 state income tax paid in 2017 will not be considered a 2017 deduction. However, I believe you can pre-pay your 2018 property taxes in 2017 and that will be allowed as a deduction.

Pay your first quarter property tax before the end of the year in order to use the full amount as a deduction on your 2017 taxes.

As the limit next year on property tax will be only 10k, you will not be able to use it on your 2018 taxes if your other 3 quarters are more than 10k.

Why doesn’t Mr Tawil mention that anyone caught up by the AMT was not deducting SALT anyway. For those of us, the new 10k deduction for SALT is great!

The final agreement eases up slightly on some service firms. It allows pass-through firms to deduct 20% of certain business income, but the break phases out for service firms owned by single filers with income above $157,500 and joint filers with income above $315,000. A last-minute change for architects and engineers exempts them from this phaseout.

Well put Mr. Kanarek,

Forgot to mention in previous comment, If you happen to be paying Estimated income tax to the state for 2017 you might as well pay it now in December of this year , As it will most likely help you more in 2017 as opposed to next year,

Mr. Kanarek at Kanarek and Co is well versed in the ongoing changes, and can really help you with your tax planning and filing.

Kanarek and Co. can also help you not only with Federal taxes but is also very good at preparing STATE taxes like N,Y N, J, PA. and so on. Have a very good Shabbos. Lakewood.