The tax inspectors in Lakewood for the revaluation are probably about half way through inspecting the properties in Lakewood, and will be here until near the end of the year.

The tax inspectors in Lakewood for the revaluation are probably about half way through inspecting the properties in Lakewood, and will be here until near the end of the year.

As earlier reported, the process was ordered by the Ocean County Board of Taxation and the New Jersey Division of Taxation to perform a Reassessment Program to be implemented for tax year 2016. The Reassessment will ensure uniform and equitable assessments throughout the municipality and account for the recent changes in the real estate market. The Township has contracted Appraisal Systems, Inc. to assist in conducting the Reassessment Program.

Township Tax Assessor Edward Seeger tells TLS there are approximately 20,000 residential properties and approximately 1,000 commercial properties in Lakewood, all which are undergoing the tax revaluation.

As stated by the officials in a TLS video in June, property owners are not required to allow the tax assessor into their homes, however, should you choose not to, they to revalue the property at its highest potential use – such as assuming you have a finished basement and more.

In addition, says Seeger, should you wish to challenge the assessment, you will need to allow the assessor into the home for the appeal.

In addition, says Seeger, should you wish to challenge the assessment, you will need to allow the assessor into the home for the appeal.

And talking about appeals, “we will make mistakes,” says Seeger. “When you get a new assessment, make sure it’s correct. Most people have one property to make sure is correct, our job is approximately 26,000 properties.” But should you feel they made a mistake, set up a meeting to discuss it, Seeger says.

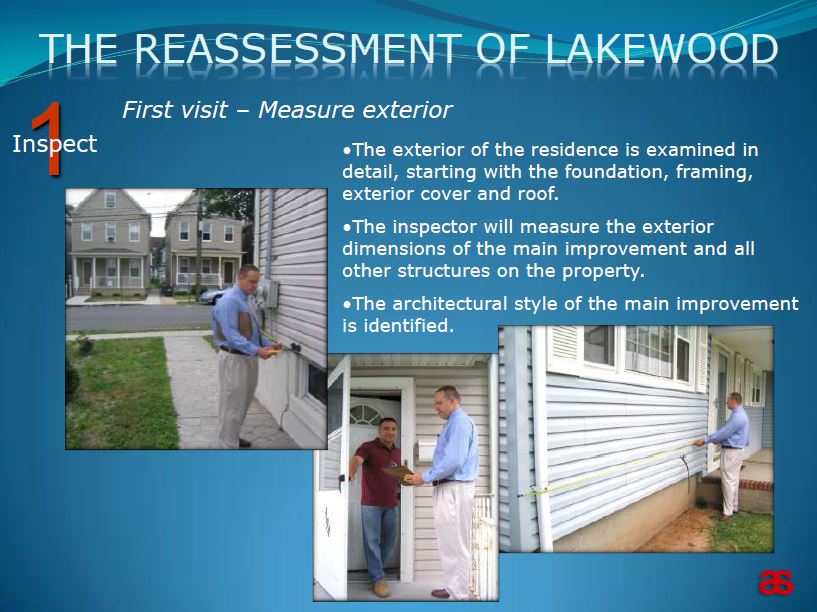

Representatives from the revaluation company will carry photo identification and their names will be registered with the Police Department and the Township. The company states, “please do not allow anyone to enter your home without proper identification. You will be requested to sign the field form used by the representative to acknowledge when an interior visit is made.”

The new property values for 2016 will be determined based on their estimated market value as of October 1, 2015 (the statutory date required by law). Property owners will be notified by mail of their proposed new assessed values.

Any inquiries with respect to the field visit and/or valuation procedure should be directed to the Appraisal Systems Inc. office at (888) 493-8530.

The inspectors are expected to be out until October/November.

Click here for a powerpoint presentation from the company explaining the process, and see previously-published video below.

[TLS]

——————————-

This content, and any other content on TLS, may not be republished or reproduced without prior permission from TLS.

Stay up to date via our news alerts, by sending ‘follow LakewoodScoop’ to the number ‘40404’ or via Twitter @LakewoodScoop

Got news? Email us at [email protected], text us 415-857-2667, tweet us @LakewoodScoop.

Why should property tax be affected by improvements I decide to make. If we are “leasing” the land and therefore pay taxes, the only relevant factor should be land value. If a tenant improves his apartment, does the landlord charge more rent?

Yanky – You are not leasing the land. You are being assessed property taxes… and the property value to which the tax applies as a percentage includes ‘improvements’ such asna dwelling and what that dwelling or any other improvement adds to the property value.

Yanky, ask better. If a guy buys a house in 1975 for $40,000, in a quiet side of town. 40 yrs later its a happening side of town and his house is worth $400,000. So now he pays taxes on $400k. He did nothing. He’s now 80 yrs okd, Retired, But his taxes are now over $11,000/yr. It’s nutso !!

The answer is simple. He should sell his now $400k house and move into a trailer. Then later sell his $400k trailer and move into a shack. THEN he should move his shack to the lesser happening side of town.

How in the world do they have these guys doing accessments? They did an accessment on my house and told me that I had 3 bathrooms, 4 bedrooms etc. they sent me a card and this is what they said but>>>>>> they were never in my house. I wonder which window he was peeking in??? Why are we paying a company that peeks in windows and gives wrong info?

When I bought my house they were charging seniors citizens only half of assessed value in taxes, now the only break they give is $250 off! That’s a real joke for someone on a fixed income. Why should I have to move from my fully paid house because I am retired, on a fixed income and can’t afford the taxes ?

My take… that is a valid question on rates for senior citizens… but is different than the complaint about their house going up in value.

To #2: Why? Why should the towns have a right to charge property taxes on improvements I do on “their “land. If the land is theirs, then the tax should purely be based on the land.

Yanky – it is not their land, it is my land. Irrelevant of that… as # 9 is explaining they tax the value of the land. The land value includes improvements. They do not include furniture and the like but rather anything intended to more or less be permanent such as a house, its size, its general features. The kind of stuff you can’t walk away with relatively easily if you ever left your land. That is just the nature of the tax. The tax is intended to be divided up among all the land by its value. This way someone owning more expensive land pays a higher portion. However… if all real estate goes up… everyone would still pay the same so long as the taxes they need to collect is not higher.

The idea of a tax based on property value is utter stupidity. While a consumption (sales) tax can be justified, with the assumption that the more that someone spends, the more they can afford to pay, and there is some justification for income tax (the more one earns, the more they can afford). A tax on property is ridiculous for the reasons stated above.

Just because someone’s neighborhood got expensive, this does not mean they can afford higher taxes. to force people to move because they can’t pay the taxes is insane.

Additionally, even with a 2% cap on rate increases, the fact is the the rate goes up, at what point is the rate irrational, when you pay 10% of your assessed value every year in taxes? 20%…30%.

If you live in your home for 30 years you are already likely to pay more over those 30 years in taxes than you are for your house.

It’s quite simple, you are being taxed on the value of what you own. What would you rather, your house be worth the same $300,000 you paid for it and your taxes stay the same, or your house be worth $600,000 and your taxes go up proportionately?

You can’t have it both ways. You want your wealth to increase but your taxes to stay the same. That’s like saying, why do I pay more taxes just because I made more money this year? Because you made more money.

Be happy your asset has appreciated so much.

Why do I pay value tax on my assets? You don’t pay income tax until you actually get the money or sell the asset.

Yanky – Welcome to the world of Property Taxes. Something New Jersey excels at. Every state of the union has it. New Jersey happens to have the highest average cost nationwide. I hate to break it to you, but so long as they pass it as law… they can tax anything in almost any way.